Market Analysis – Key Levels to Watch!

🔥 Market Analysis – Key Levels to Watch! 🔥

❗️The market is unstable, and fear is visible – but let’s break down what’s next!

♦️ Recap of Yesterday’s Analysis:

✅ We discussed the potential altcoin rally – but only if BTC.D and USDT.D confirm.

✅ We also warned about fake breakouts in alts.

Over the last 24 hours, many altcoins spiked on the 1H timeframe, but due to low volume & weak momentum, and no confirmation from BTC.D & USDT.D, a fake breakout occurred.

🟢 Current Market Outlook:

The best move right now is to wait for BTC.D and USDT.D reactions to the key levels I’ll highlight below.

If the market turns bullish & BTC dominance drops, coins like ADA, DOGE, XRP, BNB, SOL, SUI, ETH will be on my radar.

👉 I’ll try to analyze a few of these coins before the next potential move and share trade setups. 🚀 Stay tuned!

♦️ BTC (Bitcoin)

• Sellers have pushed price into buyer micro-zones.

• Key support: 111

• Two bullish scenarios:

1️⃣ Price hits 111, ranges for a while, then breaks the range top upward → long setup.

2️⃣ A sharp bullish candle forms. If BTC.D drops on the same move, I’ll look for alts near previous highs for potential entries.

♦️ USDT.D

• Support: 4.22

• Max correction: 4.51

• If this level breaks upward → short setups will be in play.

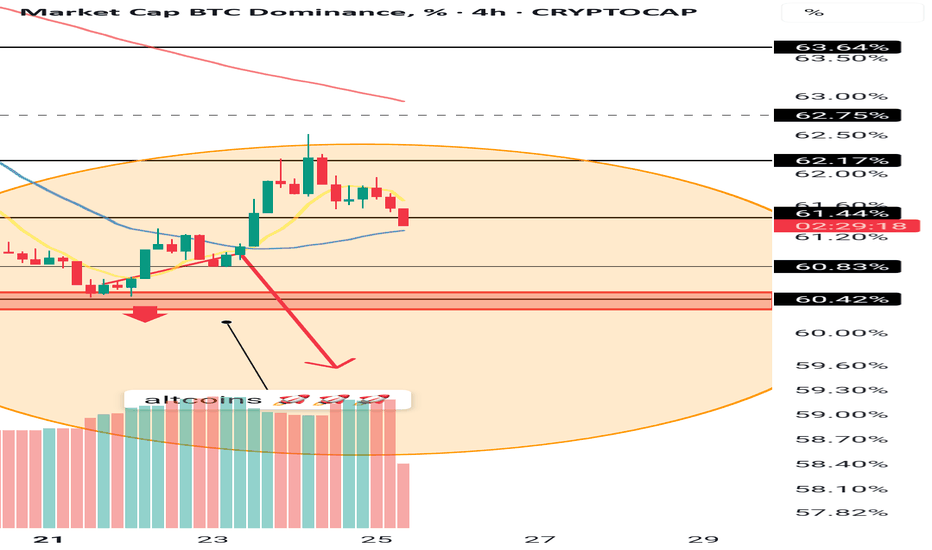

♦️ BTC.D

• Yesterday’s analysis is still valid.

• After the recent downtrend on 1D (HWC), there’s only one bullish candle.

• For alts to rally: BTC.D must break 61.6 → 60.83 → 60.42 downward.

• If BTC.D rises instead, watch 62.17 as a critical level for altcoin drop scenarios.

♦️ TOTAL (Crypto Market Cap)

• Needs to break 3.91 to confirm bullish momentum.

• Early signal: 3.85 (1H timeframe).

♦️ TOTAL2 (Altcoin Market Cap)

• Early bullish signal: 1.48

• Strong confirmation: 1.55

💎 Follow me & hit 🚀 if you want real-time updates before the next big move!

source https://www.tradingview.com/chart/BTC.D/0Xw3npp9-Market-Analysis-Key-Levels-to-Watch/

No comments:

Post a Comment